DeFi platforms, representing the pinnacle of blockchain and Web3 applications, have the potential to revolutionize finance by enabling peer-to-peer (p2p) transactions that eliminate the need for traditional financial intermediaries.

From decentralized lending platforms to crypto derivatives and asset exchanges, DeFi platforms are transforming finance with a new era of access and automation. These platforms reduce transaction fees and offer non-custodial architectures that are energizing the financial landscape.

Table of Contents

A critical challenge for DeFi platforms is ensuring ample liquidity pools, which are essential for seamless crypto asset exchanges. Without sufficient liquidity, crypto markets face increased price volatility, a situation that becomes apparent during market stress at UNISWAP v1. The launch of new DeFi solutions often highlights these challenges. For instance, Uniswap v3’s introduction of concentrated liquidity pools addressed this by allowing liquidity providers to offer capital for an asset pair within a specific price range and even on a single-sided basis. This innovation reduced impermanent losses and was further enhanced by the advent of smart contract-based Proof of Liquidity (PoL) protocols, which incentivize network liquidity and foster DeFi growth.

Proof of liquidity mechanisms incentivize users to contribute to liquidity pools, bolstering the foundation for trading and lending activities on DeFi platforms. Liquidity providers, in exchange for their risk, are rewarded with governance tokens and participate in yield farming, which grants them oversight of the platform’s operations.

Liquidity pools are swiftly becoming a cornerstone for DeFi platforms, unlocking the potential for high-speed, versatile, and viable decentralized networks. This key enabler is paving the way for new financial paradigms to meaningfully disrupt established systems.

Key Protocols before the PoL ( Proof of Liquidity)

DeFi platforms like Uniswap, Curve Finance, and Balancer are at the forefront of peer-to-peer crypto trading, showcasing innovative and pioneering de-fi models that are reshaping the financial sector.

Uniswap

The largest decentralized exchange set the standard with its automated market maker model, driven by liquidity pools and a sophisticated pricing algorithm. Participants supply ERC-20 tokens to these pools and are rewarded with UNI tokens, proportional to their contribution to the liquidity reserves. UNI holders not only gain governance rights but also enjoy reduced transaction fees. This innovative approach was adopted for all ERC-20 tokens, positioning Uniswap as the original Dex that revolutionized liquidity provision globally.

Uniswap v3 elevated its offerings by introducing concentrated liquidity provisions, enabling LPs to allocate their liquidity pools to specific token price ranges. This strategic enhancement allows for the optimization of fee earnings while adhering to predefined risk tolerances.

Among the myriad of DeFi platforms inspired by Uniswap, PancakeSwap emerged as a standout, distinguishing itself from the crowd with its unique features and offerings.

Curve Finance

Curve Finance takes a targeted approach, optimizing for high-efficiency stablecoin trading. It encourages liquidity providers to focus their liquidity pools on wrapped assets like wBTC, offering yield farming rewards. The platform’s design minimizes impermanent loss, while CRV token holders benefit from governance input and reduced trading fees.

Balancer

Diverging from Uniswap’s isolated pools, Balancer empowers users to forge and tailor multi-token liquidity pools in ratios of their choosing. Liquidity providers are incentivized to participate by earning BAL tokens, which confer governance rights, and they receive a share of the trading fees directly proportional to their stake in the liquidity reserves.

Mechanics: How does the Proof of Liquidity Protocol work?

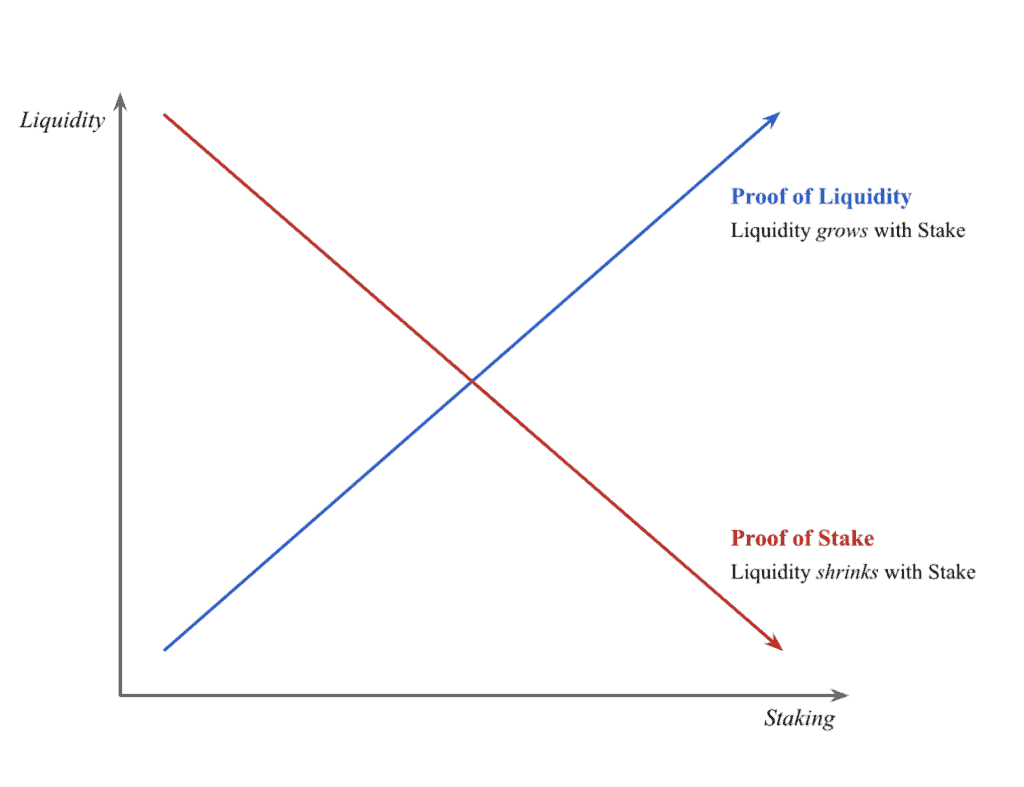

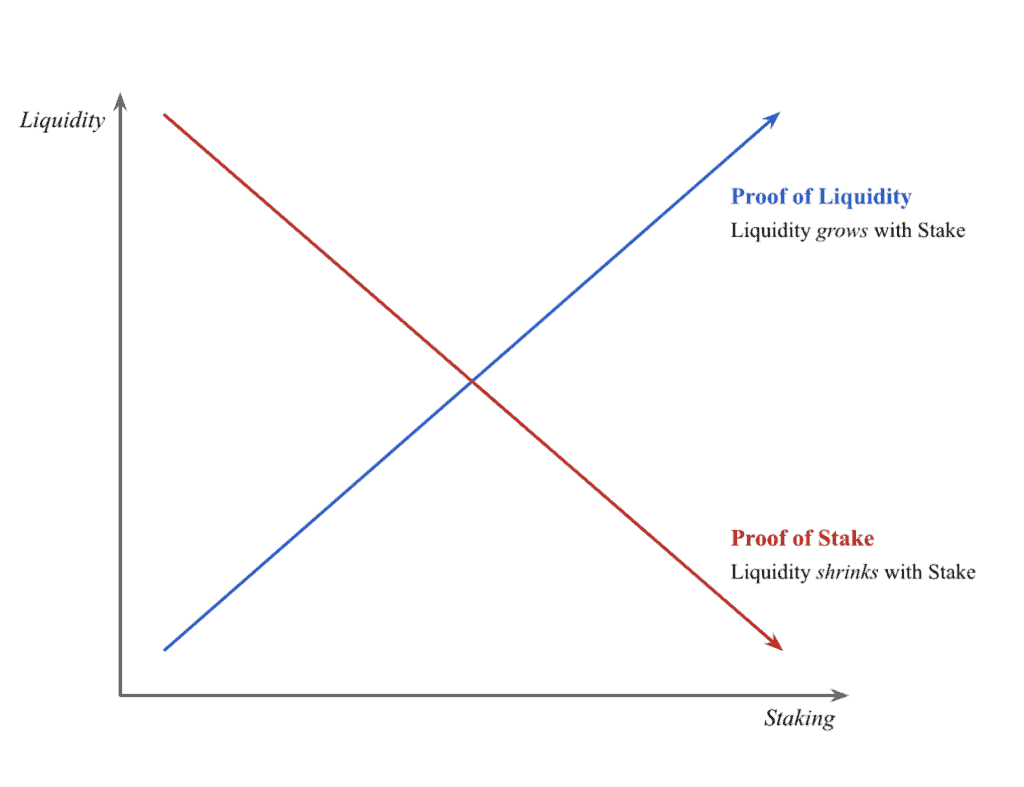

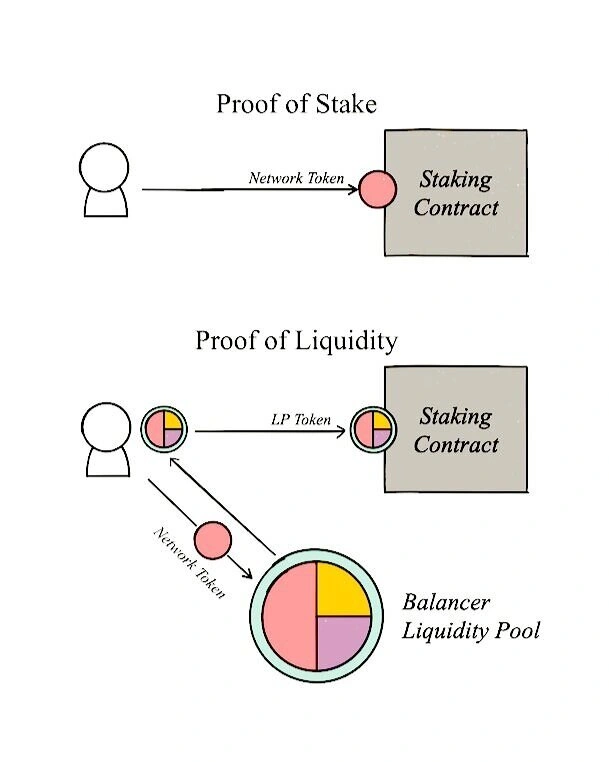

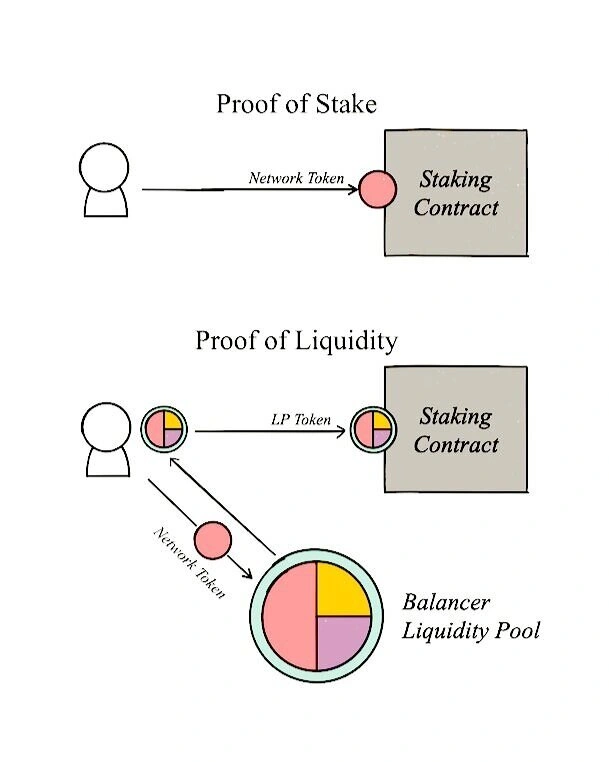

A notable challenge with the proof-of-stake (PoS) model on DeFi platforms is that increased staking activity can lead to reduced token circulation as more tokens are locked away from the market.The great examples of PoS chains are Ethereum, Polygon, and the BNB chain.

conceptWhile the Proof of Stake concept may bolster the price of a crypto coin or token, it often presents a paradox for the growth of the network or protocol, creating a counterintuitive effect on the ecosystem’s expansion. This conundrum was first highlighted in a 2020 post by a keen observer of the DeFi platforms’ dynamics, Joel monegro. He has succinctly elucidated the mechanism in his work, which was initially developed by Magenta Finance and subsequently adopted by Berachain, marking a significant advancement in DeFi platforms.

To mitigate the drawbacks of conventional methods, a balancer pool was employed, fostering a synergistic relationship between staking and liquidity. Consequently, liquidity pool tokens, known as liquidity pool tokens, were staked to validator nodes, thereby enhancing liquidity alongside staking.

A balancer pool, a cornerstone among liquidity pools, operates as an automated market maker. Its distinctive characteristics enable it to serve as both a self-regulating weighted portfolio and a price sensor.

Designed to contain a diverse array of tokens based on a predetermined index, Balancer liquidity pools facilitate trading on the Balancer decentralized exchange. The protocol’s smart design ensures that as trades occur, it automatically rebalances the pools to preserve their intended token weights.

Proof-of-Liquidity (POL) represents an innovative consensus mechanism that enhances Proof-of-Stake by resolving the issue of locked capital, which hinders DeFi efficiency. By leveraging liquidity pools as staking assets, POL unlocks staked liquidity, which in turn fosters deeper liquidity and improves capital efficiency, all while being governed by smart contract technology.

Balancer LP tokens are remarkably akin to standard LP tokens, serving as a testament to liquidity pools. These tokens are not only tradable but can also be staked, much like any other ERC-20/BEP-20 token, offering versatility in DeFi transactions.

The introduction of this innovative approach has revolutionised consensus management, maintaining the liquidity locked within liquidity pools and thus opening new avenues in liquidity management.

Related articles: Web3 Gaming is the Future of Online Gaming as 1 million new wallets joins the web 3 game space in December

Implications

By quantifying liquidity provision, proof-of-liability protocols foster trustless environments for asset exchange, eliminating counterparty risks often found in centralized exchanges. The presence of robust liquidity pools ensures minimal price slippage for market orders, even amidst high volatility.

Besides secure and efficient trading, benefits also encompass:

- Wealth generation via stacked rewards that often outstrip returns from interest accounts

- Platform ownership privileges to steward development

- Bootstrapping liquidity for long-tail assets through diversified pools

- Enabling lending protocols reliant on sufficient collateral reserves

Although liquidity pools come with the risk of impermanent loss when prices diverge, recent innovations aim to mitigate concentrated liquidity losses and minimize the downside for liquidity providers (LPs).

Overall, proof-of-liability mechanisms are maturing, providing not only enticing incentive structures but also democratizing finance on blockchain platforms through shared community ownership and the integration of liquidity pools.

Conclusion:

In conclusion, proof-of-liquidity protocols are revolutionising decentralised exchange models. While they present an efficient solution, they are not exempt from the traditional risks of decentralised finance, such as impermanent loss and the potential for misbehaving nodes, despite the security offered by liquidity pools.

Proof-of-liquidity protocols are significantly transforming asset exchange models within the decentralised finance ecosystem. They address challenges like liquidity risk, governance, and barriers to adoption, paving the way for mainstream acceptance of liquidity pools.

By quantifying and rewarding user contributions transparently, proof-of-liability protocols advance the principles of decentralization, entrusting platform control to those who contribute value through active participation in liquidity pools.

With advancements such as concentrated liquidity provisions and amalgamated pool strategies, proof of liquidity market fundamentals are set for ongoing development, leveraging liquidity pools to fulfil the extensive potential of decentralised financial systems for future generations.

Your article helped me a lot, is there any more related content? Thanks!